The Basic Principles Of Succentrix Business Advisors

Table of ContentsGetting My Succentrix Business Advisors To WorkFacts About Succentrix Business Advisors RevealedSuccentrix Business Advisors - TruthsThe Only Guide to Succentrix Business AdvisorsGetting My Succentrix Business Advisors To Work

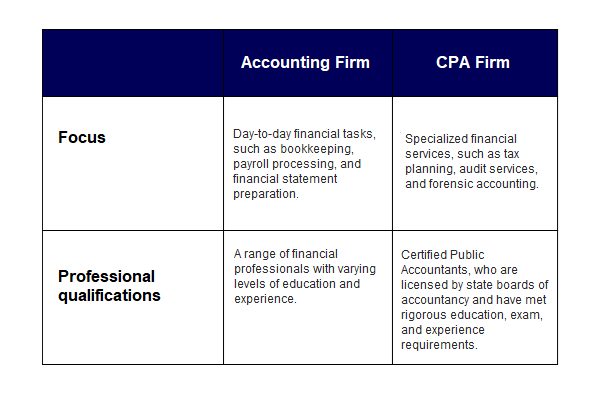

Getty Images/ sturti Outsourcing audit services can release up your time, prevent errors and also decrease your tax costs. The excessive selection of solutions might leave you frustrated. Do you require a bookkeeper or a state-licensed accountant (CPA)? Or, possibly you desire to manage your general audit tasks, like receivables, however hire a professional for money circulation projecting.Discover the different sorts of accounting solutions readily available and find out exactly how to pick the right one for your tiny organization requirements. Bookkeeping services fall under basic or economic bookkeeping. General bookkeeping refers to normal obligations, such as tape-recording purchases, whereas financial accounting plans for future development. You can hire an accountant to go into information and run records or work with a certified public accountant that supplies monetary recommendations.

Prepare and submit tax returns, make quarterly tax obligation settlements, file extensions and manage IRS audits. Create monetary declarations, including the balance sheet, revenue and loss (P&L), money flow, and revenue statements.

Not known Details About Succentrix Business Advisors

Track work hours, determine salaries, keep tax obligations, issue checks to employees and guarantee accuracy. Bookkeeping solutions may additionally consist of making pay-roll tax obligation repayments. On top of that, you can hire professionals to design and establish up your bookkeeping system, supply economic planning guidance and explain financial statements. You can outsource chief economic officer (CFO) solutions, such as succession planning and oversight of mergings and procurements.

Frequently, little company proprietors contract out tax obligation services initially and include payroll support as their firm grows., 68% of participants utilize an outside tax obligation specialist or accounting professional to prepare their firm's tax obligations.

Produce a list of procedures and responsibilities, and highlight those that you agree to outsource. Next, it's time to locate the ideal accountancy solution company (Business Valuation Services). Now that you have a concept of what sort see this page of audit solutions you need, the question is, who should you work with to provide them? For instance, while a bookkeeper handles data entry, a certified public accountant can speak on your part to the internal revenue service and offer monetary recommendations.

An Unbiased View of Succentrix Business Advisors

Prior to making a decision, consider these concerns: Do you want a regional bookkeeping professional, or are you comfy functioning basically? Should your outsourced services integrate with existing accountancy tools? Do you need a mobile application or online portal to manage your accountancy services?

Apply for a Pure Fallen Leave Tea Break Give The Pure Fallen Leave Tea Break Grants Program for little companies and 501( c)( 3) nonprofits is now open! Ideas can be brand-new or currently underway, can come from HR, C-level, or the frontline- as long as they boost worker wellness via society modification.

Something failed. Wait a minute and try once again Attempt again.

Keeping up with ever-evolving audit requirements and regulatory requirements is critical for businesses. Accounting Advisory experts aid in economic reporting, ensuring precise and certified financial declarations.

An Unbiased View of Succentrix Business Advisors

Right here's an in-depth consider these necessary skills: Analytical skills is an essential ability of Audit Advisory Solutions. You ought to excel in celebration and analyzing economic information, attracting meaningful insights, and making data-driven referrals. These skills will certainly allow you to examine financial performance, determine patterns, and offer notified guidance to your clients.

Interacting effectively to clients is a crucial ability every accountant ought to possess. You have to have the ability to communicate intricate monetary details and insights to customers and stakeholders in a clear, understandable fashion. This includes the capacity to translate monetary lingo into simple language, create comprehensive reports, and supply impactful presentations.

The Greatest Guide To Succentrix Business Advisors

Accountancy Advisory companies make use of modeling strategies to imitate numerous economic scenarios, evaluate prospective results, and support decision-making. Proficiency in financial modeling is necessary for exact projecting and strategic preparation. As an accounting advisory firm you should be well-versed in financial regulations, accounting criteria, and tax obligation laws relevant to your customers' sectors.